Image by Ralph Nas from Pixabay

In the Watec 2017 trade show, one of the keynote themes is “Bridges over troubled water: the insights and needs of water utilities”. Industry leaders from around the globe will share their perspectives on the challenges facing water utilities in the coming years. In this blog, we look at some of those challenges and bring some examples of constructive responses.

What Water Utility Executives Have to Say

The Economist surveyed 244 senior water utility executives across 10 countries regarding water utilities’ preparedness to meet supply challenges to 2030. Although conducted five years ago, the insights are still relevant today. [1] On average, 39% of the respondents thought that, globally, the risk of water demand outstripping supply is highly likely. Regarding their own utilities, 28% expected a mismatch in supply and demand by 2020, i.e., the short term, but that percentage dropped to 18% when asked about 2030. The clear impression is that there is great concern about utilities not being able to meet demand, but also that long-term steps are being taken to meet that challenge – steps that will mature by 2030 and lower the threat.

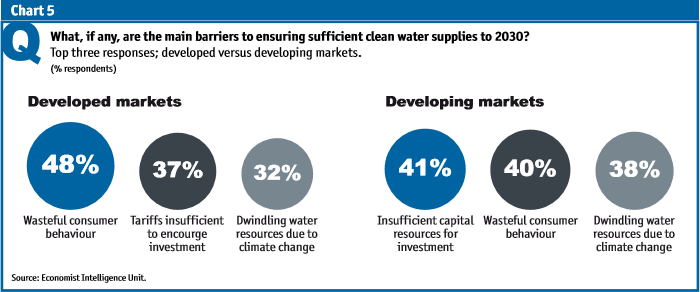

When asked what the three top barriers are to meeting supply challenges by 2030, we can see from the chart on the right that the responses differed somewhat between developed and developing markets. Across all markets wasteful consumer behavior and dwindling water resources due to climate change are perceived as significant barriers. The key difference between developed and developing markets is where they expect the money to come from for investment. In the case of developed markets, they are looking to the consumers themselves to fund the investment, while in developing markets they are looking to outside capital (governmental, NGO, private).

When queried about the three most promising technologies for ensuring adequate water supplies in their country, once again the responses between developed and developing markets were similar. Across the board new metering technologies and new technologies for tapping previously inaccessible water sources were considered key. In developed markets, new water desalination technologies also made it to the top three, while the third technology of interest in developing markets was new technologies for strengthening distribution networks.

1 Out of Every 5 Americans was Exposed to Unsafe Water over the Last Decade

Just so it’s clear that the survey results are still relevant, two weeks ago (August 16, 2017) a report was published that analyzed 680,000 EPA water quality and monitoring violations over the past decade. The results revealed that 63 million Americans, from rural central California to New York City, were exposed to potentially unsafe water. [2]

It typically took more than two years to fix the water cleanliness issues, while some are still delivering tainted water. The country’s aging water distribution pipes are susceptible to lead contamination, leaks, breaks and bacterial growth. The EPA estimates that local water systems will need to invest $384 billion over the coming decades to keep water clean, with most of that investment being in distribution pipes that are buried underground.

The Challenges are Even Greater for Smaller Utilities

In the US and around the globe, it is the smaller utilities serving rural populations that face the greatest challenge in supplying clean water. In the report cited above, local water systems serving fewer than 5,000 people accounted for a majority of the 97,800 citations for contaminated water. With fewer consumers to bear the cost of water system maintenance, let alone significant capital investments, smaller utilities have to find creative solutions for more effective financial and operational management.

Exemplary Responses

So how are water utilities around the globe coping with the challenges? Here are a few exemplary responses that could serve as models for others:

- Raising water tariffs: One of the most important resources for human survival has virtually no economic value. Across the globe, water authorities are changing this perception by raising water tariffs to levels that can ensure a sustainable supply of clean drinking water. In Israel, water tariffs jumped significantly about ten years ago, with a lot of public grumbling. However, the extra revenues were put to good use and today Israel has gone from being a water-scarce country to actually enjoying a water surplus. Earlier this month Israel’s neighbor, Egypt, under pressure from the IMF, followed suit, raising drinking water and sewage fees by as much as 50% across all consumption tiers. [3] Western Australia, a particularly arid part of the country, announced last week that water tariffs will go up an additional 4% in 2019, on top of a 6% rise already scheduled for 2018. [4] These policies are not popular, but are essential for water utilities to meet their long-term challenges.

- Massive investment in infrastructure: Following the highly publicized water contamination crisis in Flint, Michigan, massive investments are being deployed to replace all of Flint’s lead-leaking pipes by 2020. The situation in Flint was exceptional and undertaking a project of this scope over such a short period of time is unprecedented. [5] But this example teaches us two things: only massive investment can really meet water utility challenges, and it is better to make these investments in a well-planned, strategic way rather than in response to a crisis.

- Alternative energy sources: Water and wastewater treatment plants and water distribution systems consume 2-4% of the total electricity used in the US. [7] If water utilities could develop alternate energy sources (wind, solar), it would lower their operational expenses considerably. We recently came across a very interesting initiative [6]: exploiting water reservoirs for floating solar energy installations. In addition to lowering energy costs, the floating solar panels throw shade on the water surface, thus reducing evaporation and algae growth. According to some estimates, in California alone floating solar on the state’s available inland water surface area could produce more than 10% of the state’s total energy needs.

- Cooperation with electricity grids: There are clear parallels between water and electricity peak demand hours and peak demand seasons. It would be a clear advantage to both water and electric utilities if water utilities could divert surplus electricity (see the point above about alternate energy sources) back into the grid during off-peak hours. There are already some pilot projects in which water and electricity utilities are collaborating to balance electricity loads, reduce carbon emissions, improve air quality and enhance system resiliency. [7]

The Bottom Line: Water Utilities are Good Business

Perhaps the best news for the ability of water utilities to meet their challenges is that they are good business. The global water utilities industry generated $725.1 billion in revenues in 2016, representing a growth of 4.5% since 2012. [8] Most of this increase in value is due to rising prices. The water utility opportunity is not lost on investors: a chronic supply-demand problem, growing populations, and long-term, regulated contracts. Some recent examples: [9]

- American Water Works Company (NYSE: AWK): With a market cap of nearly $15 billion, its investors have doubled their money over the last 10 years.

- Algonquin Power & Utilities Corp. (NYSE: AQN): A diversified company with both electricity and water utilities, its revenue increased by 103% YoY in Q2 2017.

References

[1]James Watson, Water for all? A study of water utilities’ preparedness to meet supply challenges to 2030, Economist Intelligence Unit, 2012

[2] Agnel Philip et al, 63 Million Americans Were Exposed to Potentially Unsafe Water in the Past Decade, August 16, 2017

[3] Egypt increases cost of water by up to 50%, August 3, 2017

[4] Matt Mckenzie, Water costs need to rise, sewerage to fall: ERA, Business News Western Australia, August 21, 2017

[5] Amanda Davis, Flint is Slowing Getting Better, August 26, 2017

[6] Matt Weiser, Floating Solar Power: A New Frontier for Green-Leaning Water Utilities, August 17, 2017

[7] Bethany Sparn & Randolph Hunsberger, Opportunities and Challenges for Water and Wastewater Industries to Provide Exchangeable Services, November 2015

[8] Rahul Jadhav, Global Water Utilities Market Players’ Global Operations and Financial Performance, August 24, 2017

[9] Chris MacDonald, 3 Water Utility Stocks to Ride Earth’s Greatest Mega-Trend, August 22, 2017