One Move – Dozens of Solutions: Making Cities Smart

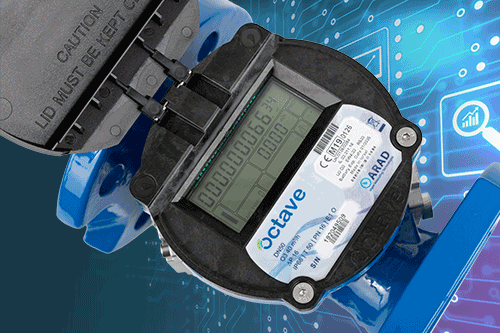

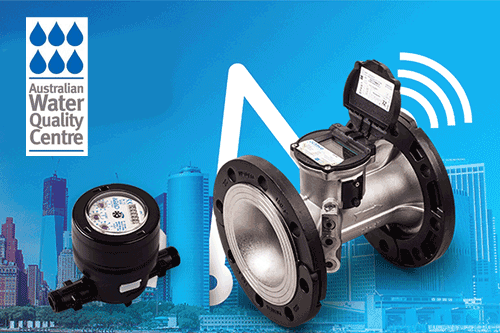

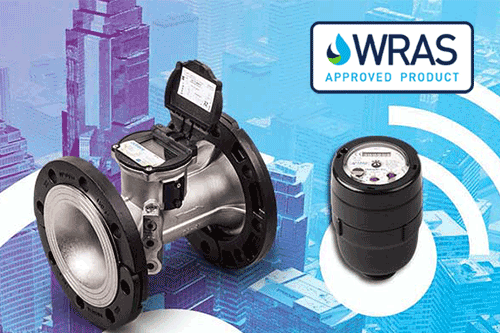

How the LoRaWAN infrastructure, which starts with water metering, is expected to become a driving force for municipal innovation in Israel and to facilitate efficient infrastructure management and improved services for residents